Public market totals $2.1 trillion

by Evan Van Zelfden, Analyst and Managing Director

![]()

The true measure of the game-industry has never been calculated—and for the first time, Games One reveals the sum total of the worldwide video-game ecosystem:

$2,187,792,674,097

as of market-close on 23 April 2021

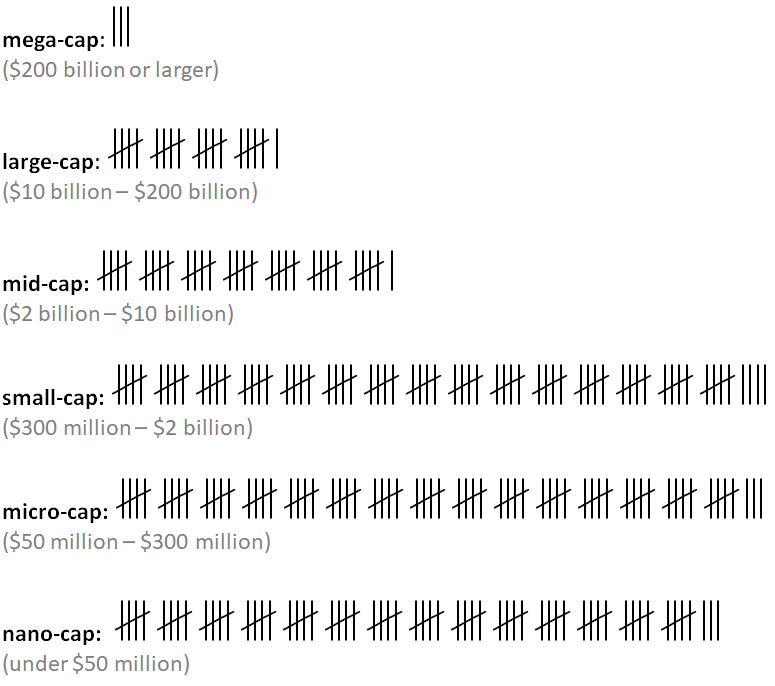

Today, there are more than three hundred publicly-traded companies that derive measurable revenue from gaming. This monograph covers the facts and figures, offers commentary and analysis, methodology, end-notes, and a codex as reference.

Table of Contents: Preface / Executive Summary / The List / Analysis / terms and disclosure

clients may request a copy of the workbook for excel

Preface

Historically, market researchers have plagued the industry with annual sales figures. These temporary indicators – while never fully agreed upon – set the narrative.

The real measure of any asset is the valuation at sale. Market prices are the realizaton of value.

This survey is calculated by taking share-price, multiplied by number-of-shares, exchanged into US Dollars as needed. (If a company derives revenue from other business segments, that percentage is excluded from the valuation.) Based on stock-exchange data, and reports published by the companies themselves, a comprehensive depiction of the sector emerges…

Findings

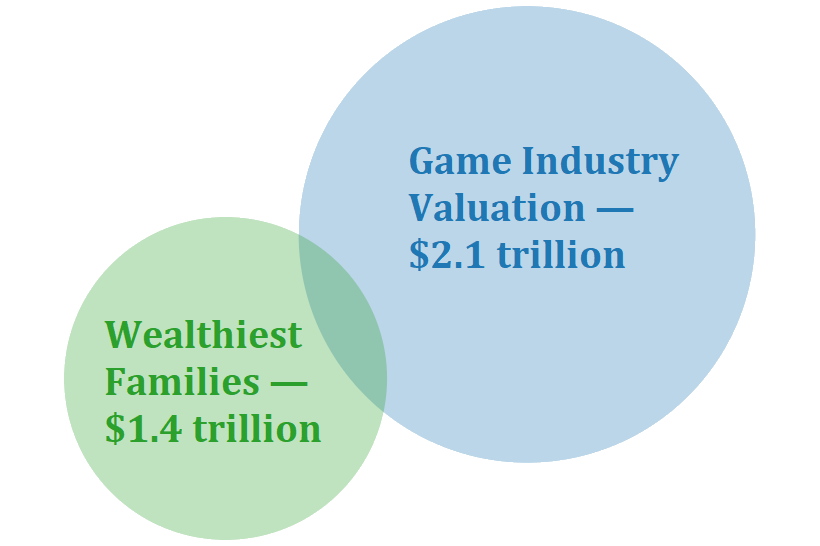

— the world’s twenty-five richest families (measured by Bloomberg in August 2020) could not afford to buy the entire game industry (measured by Games One in April 2021), even with all their combined wealth.

— the four largest public game companies represent more than half the total market; it takes another ninety companies to compose the next trillion dollars in valuation.

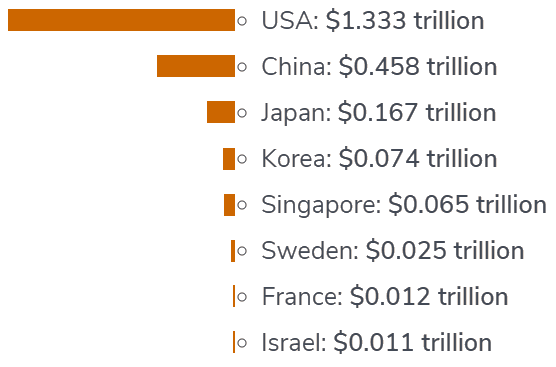

— the United States leads value-by-country, followed by China.

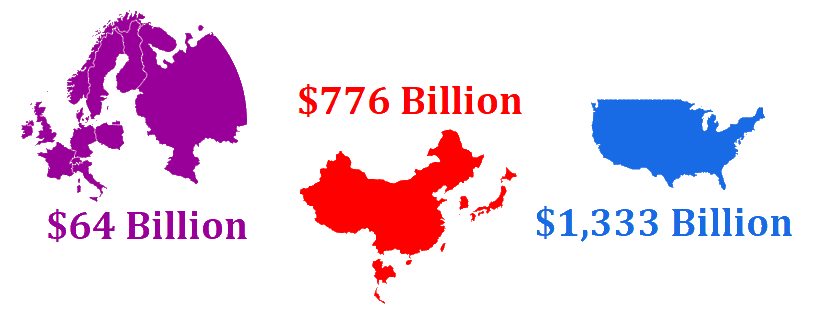

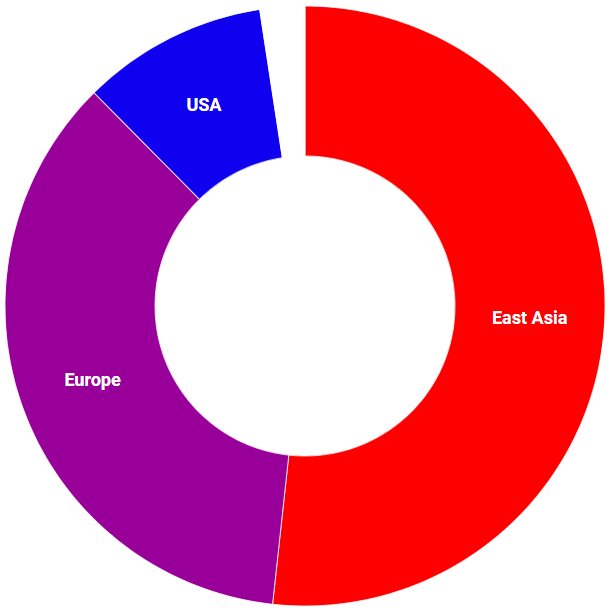

— the United States is forecast to continue annual growth in the gaming sector. Asia would need 1.7x overnight growth to reach parity with the US at current market values. Europe would need 12x overnight growth to reach parity with Asia; Europe would need 20x overnight growth to reach parity with the US.

— 5.90% of NASDAQ’s total wealth comes from games. 4.97% of the Hong Kong Stock Exchange’s total wealth comes from games. 2.99% of the Tokyo Stock Exchange’s total wealth comes from games. (These stock-exchanges, in turn, represent the world’s three largest economies.)

Top game companies by market value:

| 1. | $379 billion | Apple (Cupertino | USA) NASDAQ |

| 2. | $309 billion | Tencent (Shenzhen | China) HKEX |

| 3. | $271 billion | Google (Mountain View | USA) NASDAQ |

| 4. | $191 billion | Xbox (Redmond | USA) NASDAQ |

| 5. | $176 billion | nVIDIA (Santa Clara | USA) NASDAQ |

| 6. | $76 billion | Nintendo (Kyoto | Japan) TSE |

| 7. | $72 billion | Activision Blizzard (Santa Monica | USA) NASDAQ |

| 8. | $61 billion | Sea (Singapore | Singapore) NYSE |

| 9. | $57 billion | Netease (Hangzhou | China) NASDAQ |

| 10. | $41 billion | Electronic Arts (Redwood City | USA) NASDAQ |

| 11. | $39 billion | Roblox (San Mateo | USA) NYSE |

| 12. | $37 billion | PlayStation (Tokyo | Japan) TSE |

| 13. | $29 billion | Nexon (Tokyo | Japan) TSE |

| 14. | $28 billion | Unity (San Francisco | USA) NYSE |

| 15. | $26 billion | AMD (Santa Clara | USA) NASDAQ |

| 16. | $20 billion | AppLovin (Palo Alto | USA) NASDAQ |

| 17. | $20 billion | Take-Two Interactive (New York | USA) NASDAQ |

| 18. | $18 billion | Facebook (Menlo Park | USA) NASDAQ |

| 19. | $17 billion | Bilibili (China) NASDAQ |

| 20. | $16 billion | NCsoft (Seongnam | South Korea) KRX |

| 21. | $14 billion | Embracer (Karlstad | Sweden) Nasdaq Nordic |

| 22. | $11 billion | Zynga (San Francisco | USA) NASDAQ |

| 23. | $11 billion | Playtika (Herzliya | Israel) NASDAQ |

| 24. | $10 billion | Netmarble (Seoul | South Korea) KRX |

| 25. | $9.8 billion | Gamestop (Grapevine | USA) NYSE |

| 26. | $9.6 billion | Ubisoft (Montreuil | France) Euronext |

| 27. | $8.9 billion | Capcom (Osaka | Japan) TSE |

| 28. | $7.8 billion | 37 Interactive (Guangzhou | China) SZSE |

| 29. | $7.6 billion | Koei Tecmo (Yokohama | Japan) TSE |

| 30. | $7.2 billion | Bandai Namco (Tokyo | Japan) TSE |

| 31. | $6.7 billion | Century Huatong (Shaoxing | China) SZSE |

| 32. | $6.7 billion | Square Enix (Tokyo | Japan) TSE |

| 33. | $6.4 billion | Konami (Tokyo | Japan) TSE |

| 34. | $5.9 billion | Kingsoft (Beijing | China) HKEX |

| 35. | $5.9 billion | Skillz (San Francisco | USA) NYSE |

| 36. | $5.5 billion | Wanmei (China) SZSE |

| 37. | $4.8 billion | Logitech (Lausanne | Switzerland) NASDAQ |

| 38. | $4.8 billion | G‑bits Network (Xiamen | China) SSE |

| 39. | $4.5 billion | CD Projekt (Warsaw | Poland) WSE |

| 40. | $4.4 billion | Giant (Shanghai | China) SZSE |

| 41. | $4.3 billion | Huya (Guangzhou | China) NYSE |

| 42. | $3.9 billion | Republic of Gamers (Chinese Taipei) TWSE |

| 43. | $3.8 billion | XD Network (Shanghai |China) HKEX |

| 44. | $3.8 billion | Kakao Games (Seongnam | South Korea) KOSDAQ |

| 45. | $3.7 billion | Stillfront (Stockholm | Sweden) Nasdaq Nordic |

| 46. | $3.7 billion | Autodesk (San Rafael | USA) NASDAQ |

| 47. | $3.6 billion | Pearl Abyss (Anyang | South Korea) KOSDAQ |

| 48. | $3.3 billion | DouYu (Wuhan | China) NASDAQ |

| 49. | $3.2 billion | Razer (Singapore | Singapore) HKEX |

| 50. | $3.1 billion | Keywords Studios (Dublin | Ireland) LSE |

| 51. | $3.0 billion | Corsair (Fremont | USA) NASDAQ |

| 52. | $2.9 billion | CyberAgent (Tokyo | Japan) TSE |

| 53. | $2.8 billion | Alienware (Round Rock | USA) NYSE |

| 54. | $2.6 billion | Paradox (Stockholm | Sweden) Nasdaq Nordic |

| 55. | $2.5 billion | Sega Sammy (Tokyo | Japan) TSE |

| 56. | $2.2 billion | SciPlay (Cedar Falls | USA) NASDAQ |

| 57. | $2.2 billion | Hasbro (Pawtucket | USA) NASDAQ |

| 58. | $2.2 billion | Glu Mobile (San Francisco | USA) NASDAQ |

| 59. | $2.0 billion | Mail.ru (Moscow | Russia) LSE |

| 60. | $2.0 billion | WB Games (Burbank | USA) NYSE |

| 61. | $1.9 billion | Yoozoo (Shanghai | China) SZSE |

| 62. | $1.9 billion | IGG (Singapore) HKEX |

| 63. | $1.9 billion | Com2us (Seoul | South Korea) KOSDAQ |

| 64. | $1.9 billion | GungHo (Tokyo | Japan) TSE |

| 65. | $1.9 billion | Ourpalm (Beijing | China) SZSE |

| 66. | $1.9 billion | International Games System (Chinese Taipei) TPEx |

| 67. | $1.7 billion | Frontier Developments (Cambridge | England) LSE |

| 68. | $1.7 billion | MTG (Stockholm | Sweden) Nasdaq Stockholm |

| 69. | $1.6 billion | DeNA (Tokyo | Japan) TSE |

| 70. | $1.6 billion | mixi (Tokyo | Japan) TSE |

| 71. | $1.4 billion | Kunlun Tech (Beijing | China) SZSE |

| 72. | $1.4 billion | Team17 (Wakefield | England) LSE |

| 73. | $1.4 billion | Archosaur Games (Beijing | China) HKEX |

| 74. | $1.2 billion | GREE (Tokyo | Japan) TSE |

| 75. | $1.2 billion | Kingnet (Shanghai | China) SZSE |

| 76. | $1.2 billion | Webzen (Seongnam | South Korea) KOSDAQ |

| 77. | $1.1 billion | Enad Global 7 (Stockholm | Sweden) Nasdaq Nordic |

| 78. | $1.1 billion | DoubleU Games (Seoul | South Korea) KRX |

| 79. | $1.1 billion | Zhejiang Daily Digital (Hangzhou | China) SSE |

| 80. | $1.0 billion | CMGE (Shenzhen | China) HKEX |

| 81. | $1.0 billion | Qihoo 360 (Beijing | China) SSE |

| 82. | $1.0 billion | Electronic Soul (Hangzhou | China) SSE |

| 83. | $982 million | Huuuge Games (Warsaw | Poland) WSE |

| 84. | $957 million | Enthusiast Gaming (Toronto | Canada) TSX |

| 85. | $915 million | Colopl (Tokyo | Japan) TSE |

| 86. | $887 million | Ten Square Games (Wroclaw | Poland) WSE |

| 87. | $884 million | Kaiser China Holding (Guangdong | China) SZSE |

| 88. | $881 million | NetDragon (Fuzhou | China) HKEX |

| 89. | $861 million | PlayWay (Warsaw | Poland) WSE |

| 90. | $851 million | WeMade (Seongnam | South Korea) KOSDAQ |

| 91. | $850 million | Sumo Group (Sheffield | England) LSE |

| 92. | $831 million | Gravity (Seoul | South Korea) NASDAQ |

| 93. | $808 million | Yaoji Tech (China) SZSE |

| 94. | $787 million | Homeland ITL (Xiamen | China) HKEX |

| 95. | $781 million | Media and Games Invest (Hamburg | Germany) FSE |

| 96. | $774 million | BAIOO Family (Guangzhou | China) HKEX |

| 97. | $761 million | FriendTimes (Suzhou | China) HKEX |

| 98. | $756 million | Acer (Chinese Taipei) TWSE |

| 99. | $742 million | Remedy (Espoo | Finland) Nasdaq Nordic |

| 100. | $731 million | Neptune (Seongnam | South Korea) KOSDAQ |

| 101. | $713 million | tinyBuild (Bellevue | USA) LSE |

| 102. | $702 million | Nacon (Fretin | France) Euronext |

| 103. | $687 million | Ultrapower Software (Beijing | China) SZSE |

| 104. | $684 million | Nazara (Mumbai | India) NSE |

| 105. | $662 million | Gameloft (Paris | France) Euronext |

| 106. | $646 million | Rovio (Espoo | Finland) Nasdaq Helsinki |

| 107. | $632 million | Boton Belt (Wuxi | China) SZSE |

| 108. | $592 million | iDreamsky Technology (Shenzhen | China) HKEX |

| 109. | $555 million | G5 (Stockholm | Sweden) Nasdaq Nordic |

| 110. | $537 million | Sohu (Beijing | China) NASDAQ |

| 111. | $534 million | Akatsuki (Tokyo | Japan) TSE |

| 112. | $532 million | PCF Group (Warsaw | Poland) WSE |

| 113. | $531 million | Soft-World (Chinese Taipei) TPEx |

| 114. | $528 million | Shunwang Tech (Hangzhou | China) SZSE |

| 115. | $522 million | Thunderful (Gothenburg | Sweden) Nasdaq Nordic |

| 116. | $487 million | ThumbAge (Seongnam | South Korea) KOSDAQ |

| 117. | $476 million | Neowiz (Seongnam | South Korea) KOSDAQ |

| 118. | $464 million | Nexon GT (Seongnam | South Korea) KOSDAQ |

| 119. | $461 million | Bigben Interactive (Fretin | France) Euronext |

| 120. | $454 million | Turtle Beach (White Plains | USA) NASDAQ |

| 121. | $446 million | Focus Home Interactive (Paris | France) Euronext |

| 122. | $442 million | Shenzhen Bingchuan (Shenzhen | China) SZSE |

| 123. | $433 million | SNK (Osaka | Japan) KASDAQ |

| 124. | $426 million | Dalian Zeus Entertainment (Beijing | China) SZSE |

| 125. | $406 million | Gamania (Chinese Taipei) TPEx |

| 126. | $406 million | Digital Bros (Milano | Italy) Borsa Italiana |

| 127. | $404 million | Fuchun Technology (Fuzhou | China) SZSE |

| 128. | $396 million | Hifuture Electric (Shenzhen | China) SZSE |

| 129. | $390 million | JoyCity (Seongnam | South Korea) KOSDAQ |

| 130. | $388 million | Marvelous (Tokyo | Japan) TSE |

| 131. | $366 million | Nat Games (Seoul | South Korea) KOSDAQ |

| 132. | $363 million | Shengxunda Technology (Shenzhen | China) SZSE |

| 133. | $346 million | Dasheng Times Cultural (Shenzhen | China) SSE |

| 134. | $344 million | The9, Ltd. (Shanghai | China) NASDAQ |

| 135. | $341 million | Motorsport Games (Miami | USA) NASDAQ |

| 136. | $337 million | gumi (Tokyo | Japan) TSE |

| 137. | $334 million | 11 bit studios (Warsaw | Poland) WSE |

| 138. | $311 million | X-Legend Entertainment (Chinese Taipei) TWSE |

| 139. | $310 million | Asetek (Aalborg | Norway) Oslo Børs |

| 140. | $299 million | Gamevil (Seoul | South Korea) KOSDAQ |

| 141. | $286 million | KLab (Tokyo | Japan) TSE |

| 142. | $266 million | LEAF Mobile (Vancouver | Canada) TSX |

| 143. | $254 million | Morningstar (Dalian | China) SZSE |

| 144. | $253 million | Coly (Tokyo | Japan) TSE |

| 145. | $251 million | Atari (Paris | France) Euronext |

| 146. | $244 million | Guillemot Corporation (Chantepie | France) Euronext |

| 147. | $242 million | Tangel Culture (Changsha | China) SZSE |

| 148. | $241 million | Tianrun Digital Entertainment (Hunan | China) SZSE |

| 149. | $240 million | EGLS (Zhejiang | China) SZSE |

| 150. | $217 million | Talkweb (Hunan | China) SZSE |

| 151. | $211 million | ZNHI (Jiangyin | China) SZSE |

| 152. | $200 million | Drecom (Tokyo | Japan) TSE |

| 153. | $196 million | Me2On (Seoul | South Korea) KOSDAQ |

| 154. | $196 million | Fractal (Gothenburg | Sweden) Nasdaq Nordic |

| 155. | $195 million | Rastar (Guangzhou | China) SZSE |

| 156. | $195 million | Jinke Culture (Hangzhou | China) SZSE |

| 157. | $167 million | DONTNOD (Paris | France) Euronext |

| 158. | $167 million | ZQGame (Shenzhen | China) SZSE |

| 159. | $166 million | Zengame Tech (Shenzhen | China) HKEX |

| 160. | $166 million | Yuanli Active (Nanping | China) SZSE |

| 161. | $165 million | Chinese Gamer International (Chinese Taipei) TPEx |

| 162. | $162 million | Creepy Jar (Warsaw | Poland) WSE |

| 163. | $157 million | All in! Games (Krakow | Poland) WSE |

| 164. | $152 million | Juli Culture (China) SZSE |

| 165. | $151 million | Surfilter Network Tech (Shenzhen | China) SZSE |

| 166. | $143 million | Mgame (Seoul | South Korea) KOSDAQ |

| 167. | $143 million | Hanbit Soft (Seoul | South Korea) KOSDAQ |

| 168. | $140 million | Chengdu B-ray Media (Chengdu | China) SSE |

| 169. | $139 million | Aiming (Tokyo | Japan) TSE |

| 170. | $139 million | Benoholdings (Seoul | South Korea) KOSDAQ |

| 171. | $132 million | Userjoy Technology (Chinese Taipei) TPEx |

| 172. | $132 million | Play Magnus (Oslo | Norway) Euronext |

| 173. | $131 million | MAG (Stockholm | Sweden) Nasdaq Nordic |

| 174. | $129 million | GameWith (Tokyo | Japan) TSE |

| 175. | $123 million | Zordix (Umeå | Sweden) NGM |

| 176. | $121 million | Cultural Investment Holdings (Beijing | China) SSE |

| 177. | $119 million | SLG (Santa Monica | USA) NASDAQ |

| 178. | $116 million | Mobile Factory (Tokyo | Japan) TSE |

| 179. | $116 million | Funko (Everett | USA) NASDAQ |

| 180. | $114 million | Softstar (Chinese Taipei) TPEx |

| 181. | $114 million | FingerTango (Guangzhou | China) HKEX |

| 182. | $114 million | Bank of Innovation (Tokyo | Japan) TSE |

| 183. | $113 million | Tobii (Stockholm | Sweden) Nasdaq Stockholm |

| 184. | $108 million | Sino-Entertainment (China) HKEX |

| 185. | $102 million | Dinglong Culture (China) SZSE |

| 186. | $101 million | Happinet (Tokyo | Japan) TSE |

| 187. | $100 million | Starbreeze (Stockholm | Sweden) Nasdaq Stockholm |

| 188. | $98 million | Asiasoft (Bangkok | Thailand) SET |

| 189. | $97 million | Bewinner Communications (Beijing | China) SZSE |

| 190. | $95 million | Actoz Soft (Seoul | South Korea) KOSDAQ |

| 191. | $94 million | BoomBit (Gdansk | Poland) WSE |

| 192. | $93 million | Flexion Mobile (London | England) Nasdaq Nordic |

| 193. | $92 million | PlaySide Studios (Melbourne | Australia) ASX |

| 194. | $89 million | The Farm 51 (Gliwice | Poland) NewConnect |

| 195. | $81 million | One More Level (Krakow | Poland) NewConnect |

| 196. | $81 million | Bloober Team (Krakow | Poland) NewConnect |

| 197. | $80 million | Ateam (Nagoya | Japan) TSE |

| 198. | $77 million | Next Games (Helsinki | Finland) Nasdaq Nordic |

| 199. | $76 million | AltPlus (Tokyo | Japan) TSE |

| 200. | $72 million | MacroWell OMG Digital (Chinese Taipei) TPEx |

| 201. | $67 million | CI Games (Warsaw | Poland) WSE |

| 202. | $66 million | FeiYu (Guilin | China) HKEX |

| 203. | $65 million | Mynet (Tokyo | Japan) TSE |

| 204. | $64 million | Enish (Tokyo | Japan) TSE |

| 205. | $62 million | Qiiwi Games (Alingsås | Sweden) Nasdaq Nordic |

| 206. | $59 million | Hunan TV & Broadcast (Changsha | China) SZSE |

| 207. | $59 million | Wayi (Chinese Taipei) TPEx |

| 208. | $59 million | Movie Games (Warsaw | Poland) NewConnect |

| 209. | $58 million | Tose (Kyoto | Japan) TSE |

| 210. | $57 million | Forever (Gdynia | Poland) NewConnect |

| 211. | $54 million | Boyaa (Shenzhen | China) HKEX |

| 212. | $54 million | Cave (Tokyo | Japan) TSE |

| 213. | $54 million | Gfinity (London | England) LSE |

| 214. | $53 million | Artifex Mundi (Katowice | Poland) WSE |

| 215. | $52 million | PopReach (Toronto| Canada) TSXV |

| 216. | $52 million | Nippon Ichi Software (Kakamigahara | Japan) TSE |

| 217. | $52 million | Cyberstep (Tokyo | Japan) TSE |

| 218. | $46 million | Kopin (Westborough | USA) NASDAQ |

| 219. | $43 million | Linekong Interactive (Beijing | China) HKEX |

| 220. | $42 million | Lianzhong (Beijing | China) HKEX |

| 221. | $42 million | Ultimate Games (Warsaw | Poland) WSE |

| 222. | $41 million | Blue Hat Interactive (Xiamen | China) NASDAQ |

| 223. | $41 million | Guild Esports (London | England) LSE |

| 224. | $40 million | SimFabric (Warsaw | Poland) NewConnect |

| 225. | $40 million | Starward Industries (Krakaw | Poland) NewConnect |

| 226. | $40 million | Immersion (San Jose | USA) NASDAQ |

| 227. | $39 million | Datang Telecom Technology (Beijing | China) SSE |

| 228. | $38 million | Yuke’s (Tokyo | Japan) TSE |

| 229. | $37 million | Alpha Group (Guangzhou | China) SZSE |

| 230. | $36 million | Mobcast (Tokyo | Japan) TSE |

| 231. | $32 million | Bublar Group (Stockholm | Sweden) Nasdaq Nordic |

| 232. | $32 million | Jiu Zun Digital (Guangzhou | China) HKEX |

| 233. | $32 million | Safe Lane Gaming (Stockholm | Sweden) NGM |

| 234. | $32 million | Silicon Studio (Tokyo | Japan) TSE |

| 235. | $29 million | Mighty Kingdom (Adelaide | Australia) ASX |

| 236. | $28 million | CreativeForge (Warsaw | Poland) NewConnect |

| 237. | $25 million | Games Operators (Warsaw | Poland) WSE |

| 238. | $25 million | Star Vault (Malmö | Sweden) NGM |

| 239. | $25 million | Digital Hollywood (Guangzhou | China) HKEX |

| 240. | $24 million | Forgame (Guangzhou | China) HKEX |

| 241. | $24 million | A8 New Media Group (Shenzhen | China) HKEX |

| 242. | $22 million | InterServ (Chinese Taipei) TPEx |

| 243. | $21 million | PyramidGames (Lublin | Poland) NewConnect |

| 244. | $21 million | Gaming Factory (Warsaw | Poland) WSE |

| 245. | $21 million | Carbon Studio (Chorzow | Poland) NewConnect |

| 246. | $20 million | FuRyu (Tokyo | Japan) TSE |

| 247. | $19 million | Incuvo (Katowice | Poland) NewConnect |

| 248. | $16 million | Momo (Beijing | China) NASDAQ |

| 249. | $15 million | Gaming Corps (Uppsala | Sweden) Nasdaq Nordic |

| 250. | $14 million | Cherrypick Games (Warsaw | Poland) NewConnect |

| 251. | $12 million | Vivid Games (Bydgoszcz | Poland) WSE |

| 252. | $11 million | Jumpgate (Visby | Sweden) NGM |

| 253. | $10 million | ECC Games (Warsaw | Poland) NewConnect |

| 254. | $10 million | 5th Planet Games (Copenhagen | Denmark) Euronext |

| 255. | $10 million | U9Game (Shanghai | China) SSE |

| 256. | $9.7 million | Kool2Play (Warsaw | Poland) NewConnect |

| 257. | $9.7 million | Klabater (Warsaw | Poland) NewConnect |

| 258. | $9.4 million | VARSAV (Warsaw | Poland) NewConnect |

| 259. | $9.3 million | QubicGames (Siedlce | Poland) NewConnect |

| 260. | $9.3 million | Game Chest (Stockholm | Sweden) NGM |

| 261. | $8.7 million | Skinwallet (Szczecin | Poland) NewConnect |

| 262. | $8.1 million | Play2Chill (Warsaw | Poland) NewConnect |

| 263. | $7.8 million | No Gravity Games (Warsaw | Poland) NewConnect |

| 264. | $7.7 million | BTC Studios (Warsaw | Poland) NewConnect |

| 265. | $7.7 million | Duality Games (Warsaw | Poland) NewConnect |

| 266. | $7.6 million | The Dust (Wroclaw | Poland) NewConnect |

| 267. | $7.5 million | Draw Distance (Krakaw | Poland) NewConnect |

| 268. | $7.4 million | Nitro Games (Kotka | Finland) Nasdaq Nordic |

| 269 | $7.3 million | Simteract (Lublin | Poland) NewConnect |

| 270. | $7.1 million | T-Bull (Wroclaw | Poland) WSE |

| 271. | $6.9 million | Sonka (Warsaw | Poland) NewConnect |

| 272. | $6.7 million | Gameone Holdings (Hong Kong) HKEX |

| 273. | $6.5 million | Ovid Works (Warsaw | Poland) NewConnect |

| 274. | $6.3 million | Polyslash (Krakow | Poland) NewConnect |

| 275. | $6.1 million | Moonlit (Krakaw | Poland) NewConnect |

| 276. | $6.0 million | United Label Games (Warsaw | Poland) NewConnect |

| 277. | $4.9 million | Jujubee (Katowice | Poland) NewConnect |

| 278. | $4.3 million | Gold Town Games (Skellefteå | Sweden) NGM |

| 279. | $3.9 million | 7LEVELS (Krakaw | Poland) NewConnect |

| 280. | $3.5 million | Detalion Games (Warsaw | Poland) NewConnect |

| 281. | $3.3 million | Meisheng Cultural (Hangzhou | China) SZSE |

| 282. | $3.2 million | Art Games Studio (Warsaw | Poland) NewConnect |

| 283. | $3.1 million | Atomic Jelly (Poznan | Poland) NewConnect |

| 284. | $3.1 million | Shockwork Games (Lublin | Poland) NewConnect |

| 285. | $2.5 million | Red Dev Studio (Olsztyn | Poland) NewConnect |

| 286. | $2.0 million | Huckleberry Games (Ponzan | Poland) NewConnect |

| 287. | $1.8 million | Drageus Games (Warsaw | Poland) NewConnect |

| 288. | $1.4 million | Falcon Games (Warsaw | Poland) NewConnect |

| 289. | $1.4 million | Prime Bit Games (Rzeszow | Poland) NewConnect |

| 290. | $0.8 million | Macro Games (Wroclaw | Poland) NewConnect |

Notes:

— share prices fluctuate by the moment, as do currency exchange-rates. This monograph is intended as a snapshot-in-time that shows the last twelve months, and gives guidance on what the next twelve months may look like based on current positions.

— all prices in US Dollars as of market close on 23 April 2021.

— SPACs are currently in-process for IronSource at an $11.1 billion valuation, Nexters at a $1.9 billion valuation, and Playstudios at a $1.1 billion valuation.

— new public offerings will continue for the foreseeable future. Krafton applied to KRX on 8 April 2021.

— as of 30 April 2021, Glu Mobile has been de-listed from NASDAQ.

— private companies are not included in this valuation. (If the world’s most valuable game developer has a private valuation of $28 billion, that represents 1.28% of the total current public market. Pre-IPO valuations are not significant in aggregate.)

— stock exchanges note that individual companies may have other share classes not listed on their exchange; while a decidedly rare possibility, that would make the total market valuation higher than is listed here.

— numbers posted by companies may be audited, or unaudited.

— this instrument covers the globe, and each element of the game-industry value-chain.

— this instrument excludes gambling companies.

— because of language barriers and reporting issues, the data from China may be a cycle behind, and still representatively accurate.

— the author would like to thank Dr. Stacy Ragson of Bernstein, Rick Schafer and Wei Mok of Oppenheimer, Brett Simpson of Arete, Matt Bryson of Wedbush, and Tristan Gerra of Baird.

— while there are potential errors in any detail, the combined depiction is wholly accurate.

Analysis

— game usage occurs everywhere on earth; game development is equally represented. Only 22 of the world’s countries, some 11%, have a publicly-listed game company. Spread across 20 different exchanges, those markets are domiciled in only 15 different countries. This shows a strong concentration of value for what is a universal activity.

— East Asia has the most public game companies, with 150 measured here (more than half of the 290 total). Europe has 104 (more than a third, and fifty-eight of those in Poland alone). The US has 29 public game companies, just 10%. The remaining seven are in Australia, Canada, Israel, and India. Number of companies-per-country does not correlate to a higher total market value. Further, there are no listed companies from Latin America or Africa.

— China has more public game companies than any country on earth. In 2017, there were over a hundred listed on the National Equities Exchange and Quotations. There’s no perfect data for such a large, complex, important market. This valuation sampled seventy-five top Chinese companies across the stock-exchanges Hong Kong, Shenszen, Shanghai, New York and NASDAQ. No game industry monograph is accurate without calculating China; this report is likely to under-report.

— there are 82 companies with market-capitalizations above one billion dollars. This number is likely to increase in two ways: the other two-hundred-eight companies on this list can grow annually, and new companies can be offer on public markets.

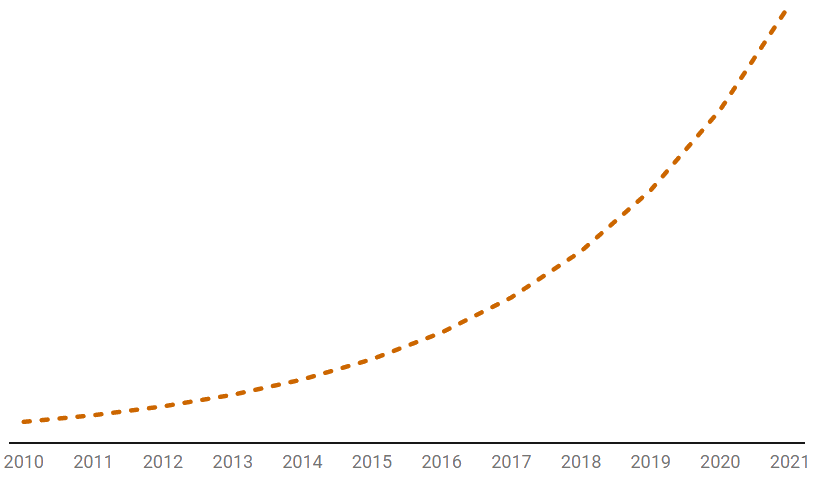

— In 2010, a defunct investment bank gave a presentation at a local festival. There’s no record of the data and methodology, but a trade-paper quoted the speech. The claim was: the global game industry market cap was $105 billion. Today’s total-industry-valuation of $2.1 trillion from Games One is definitive. An interesting, if speculative notion, that the sector achieved more than 20x growth in the last decade.

Conclusion:

In 2008, games proved recession-proof. In 2020, games proved pandemic-proof. We can forecast that, pending an extinction-level event, the game industry will forever prosper.

![]()

Terms of Use: the 290 public game companies listed above have full license to use this report. Journalists may reproduce the report in part for news purposes. Securities analysts may reproduce in part or in whole, with proper credit. Investment bankers may not use the data without prior written permission. This work is protected by copyright. Charging for this information is prohibited. Market research firms are prohibited from using this information. Statista is particularly prohibited from using this data in any form. Any other use requires permission. By accessing this site, you agree to the above terms.

Analyst disclosure: the author of this report has no ownership of any of the securities listed, and has no plans to take a position in the future. Games Ône does business with – and seeks to do business with – every company in the interactive entertainment sector.

Authored by Evan Van Zelfden, Analyst and Managing Director, Games Ône

Contact: ![]()